Analytics is no longer a “good-to-have” add-on in procurement—it is the engine that drives decision-making, cost optimisation, supplier strategy, and resilience. Direct material sourcing, in particular, is a deeply data-intensive process. Every decision revolves around spend, savings, suppliers, categories, engineering data, BOM structures, cost breakdowns, and technical specifications. Extracting the right insights from this data and applying them intelligently can dramatically elevate a sourcing organisation’s maturity.

According to the Deloitte Global CPO Survey 2021, over 91% of high-performing procurement teams identify their ability to deliver cost reductions as the most important KPI. Analytics is the foundation that enables these teams to move from reactive firefighting to proactive value creation.

For manufacturers, the stakes are even higher. Direct materials influence product cost, quality, design feasibility, production timelines, and supply chain continuity. The right analytics can help companies reduce costs, uncover supply risks, align sourcing with engineering, and accelerate NPD/NPI cycles.

This blog explores how manufacturers can use direct material sourcing analytics to strengthen procurement decisions and build a more resilient, cost-efficient supply chain.

Beyond Standard Sourcing KPIs: Why Direct Material Analytics Is Different

Traditional procurement analytics generally focus on:

- Spend

- Savings

- Supplier performance

- Categories

- Contract compliance

- Price trends

While these metrics remain essential, direct sourcing requires an additional analytical layer that connects procurement with engineering and product development. This is where BOM analytics, should-costing, cost breakdown analysis, and part-level intelligence become critical.

These specialised analytics help sourcing teams:

- Spot high-impact cost opportunities earlier

- Evaluate part alternatives more accurately

- Validate supplier quotations

- Avoid over-specification or duplicate parts

- Reduce reliance on outdated spreadsheets

- Accelerate sourcing during NPD/NPI

- Strengthen negotiations with data-backed benchmarks

Table of Contents

ToggleBoM Analytics: Unlocking Hidden Value in Your Product Structure

A Bill of Materials (BoM) is more than a list of components—it is a detailed financial blueprint of your product. Every part, supplier, design revision, and engineering decision contributes to the total cost. Yet most organisations fail to fully utilise the intelligence their BOMs contain.

1.BoM Price Analysis

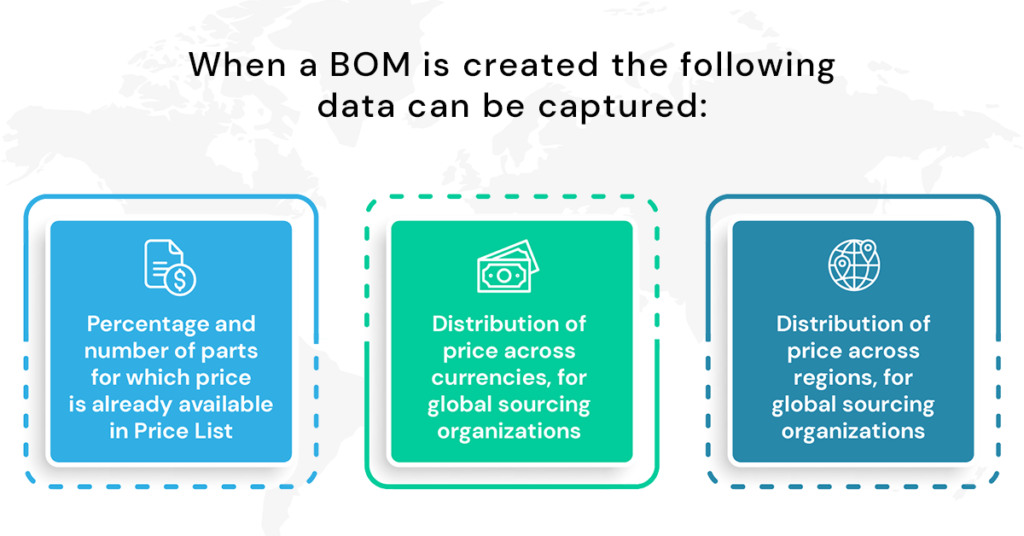

When a new BOM or BOM revision is created, comparing its components with existing price lists or historical sourcing data can generate immediate insights, such as:

- Percentage and volume of parts with known pricing

- Distribution of cost across currencies (critical for global sourcing)

- Regional supplier allocation and exposure

- Estimated cost for the BOM based on available price data

- Currency risk exposure for multi-region sourcing

This gives procurement an early estimate of BOM cost structure even before the sourcing cycle begins.

2. Understanding Cost Drivers Across BOM Versions

By analysing different versions of a BOM, manufacturers can:

- Identify cost increases driven by design changes

- Highlight parts with consistent price volatility

- Flag components with high dependency risks

- Evaluate whether cost movements are design-driven or supplier-driven

This is crucial for NPD/NPI teams trying to reduce product cost without compromising performance.

Similar Parts Analysis: Reducing Costs Without Redesigning the Product

During NPD, engineers focus primarily on design effectiveness—selecting parts that meet performance goals. Procurement, however, must view these selections through the lens of price effectiveness.

Similar Parts Analysis compares part attributes in the BOM with:

- Existing price lists

- Internal catalogues

- Previously sourced components

- Supplier catalogs

- Historical performance data

This helps identify alternative parts with equivalent specifications but better pricing or availability.

For example:

- A component specified in the design may have a nearly identical part already being procured at scale for another assembly line at a lower cost.

- A supplier may offer a comparable spec part with shorter lead time or more favourable commercial terms.

This analysis enables collaboration between sourcing and engineering, ensuring the final BOM is optimised not only for performance but also for cost and manufacturability.

The Power of Should-Cost Analysis in Strategic Direct Material Sourcing

I

Entering a negotiation without a clear, data-driven target price is the equivalent of walking into the room blindfolded. In direct procurement, where every component carries technical specificity, quality requirements, and supply-risk implications, relying on supplier quotes alone is no longer viable. This is where should-cost analysis (often called should-be price analytics) becomes indispensable.

Should-cost modeling builds a transparent, bottom-up estimate of what a part or assembly should cost under normal market and production conditions. It factors in raw material indices, manufacturing processes, cycle times, labor rates, supplier overheads, tooling amortization, logistics, and regional cost differences, and reasonable profit margins. The result is an objective benchmark that allows procurement teams to validate quotes, detect hidden margins, and negotiate from a position of strength rather than hope.

Yet building and maintaining credible should-cost models at scale has historically been painful. Organizations struggle with fragmented part data, outdated cost histories, incomplete process mappings, and the constant effort required to keep models current. Without automation, these models remain trapped in spreadsheets, updated sporadically, and accessible to only a handful of experts.

When done right, however, should-cost capability transforms direct sourcing from a reactive, quote-driven exercise into a proactive, insight-led discipline. Teams can systematically identify overpricing, drive standardization across commodity families, reduce dependency on supplier-provided breakdowns, and ultimately capture millions in sustainable savings.

Why Direct Sourcing Analytics Matter

Direct sourcing is a different league of complexity. Every part comes with its own technical depth, including engineering drawings, CAD files, revision histories, quality requirements, compliance expectations, material specifications, and production timelines that constantly shift. Decisions in this space are never simple yes-or-no approvals; they depend on real-time visibility across all these moving pieces.

When analytics are strong, sourcing teams can finally operate with clarity. They know which suppliers are right for each part and commodity category, where the risks are, how costs are evolving, and how early design choices will influence downstream spend. The organisation moves away from reactive firefighting and toward genuinely strategic decision-making. Collaboration between engineering, procurement, suppliers, and R&D becomes smoother because everyone is referring to the same truth instead of conflicting versions buried in spreadsheets. New product development and introduction becomes faster, cleaner, and far more predictable

But when data is outdated or fragmented, sourcing becomes guesswork. Costs get misjudged. Supplier choices become inconsistent. Engineering teams work on one version of a spec while procurement works on another. Delays multiply. Rework increases. And the supply chain quietly absorbs hidden costs that only become visible when it is too late to fix them. Poor analytics do not just inconvenience teams; they directly harm profitability, timelines, and customer commitments.

The Way Forward: A Unified Direct Material Sourcing Platform

The only sustainable way to manage this complexity is through a unified sourcing environment that consolidates everything from BOM structures and engineering revisions to supplier information, procurement history, should-cost insights, spend data, and even CAD or PLM inputs. When this ecosystem is connected, teams finally get a dependable single source of truth. Self-service analytics eliminate the dependency on IT or manual spreadsheets, allowing sourcing professionals to analyse cost drivers, compare suppliers, validate pricing, or identify part similarities without friction. Decisions become faster and more consistent because the organisation is aligned around one dataset rather than scattered interpretations of it.

How MeRLIN Strengthens Direct Material Sourcing Analytics

MeRLIN is built specifically for this world of high-volume engineering changes, multi-level BOMs, complex specifications, and supplier ecosystems that need precise, continuous coordination. It brings engineering, procurement, and supplier data into one place so teams do not have to chase information across disconnected systems. With engineering change management built in, similar part discovery, should-cost modelling, supplier collaboration features, and real-time integrations with ERP and PLM environments, the platform transforms fragmented workflows into a cohesive sourcing engine.

The result is straightforward. Manufacturers move faster, negotiate smarter, and maintain material availability without scrambling. Costs become transparent and predictable. Supplier choices become data-driven. And sourcing teams finally gain the analytical foundation needed to support both daily purchasing tasks and long-term strategic planning.

3 comments

Nice post. Waiting for your next article.

Thank you for commenting. We are glad you liked this post! Keep reading!

Great post! Thanks for sharing . It can be easily implemented .