Eight years ago, I published a post on HBR, that summarized extensive research I had undertaken to understand how risk creates cost in any supply chain. My work was different from most other supply chain risk research in that I was concerned with how risk creates actual, every-day cost in supply chains and not hypothetical cost, e.g., that of a temporary disruption such as a weather-related event. In other words, I wanted to look at risk more from the point of view of an active stock trader, managing the risk of every transaction, and less as an insurance underwriter, worried about a low-probability event.

In the HBR post, I summarized my cost of risk theory thus:

Risk in the supply chain is not a potential cost — it is an actual cost, very real and borne by every product and service company, whether they understand it or not.

Let’s start by defining what we mean by risk, which is simply the possibility of more than one outcome (of unequal values) to a given future state. The possibility of more than one future outcome can very easily generate a cost in the present. How so? Because the fact that value is not guaranteed in the future lessens value in the present. This reduction in value is present and represents a cost today, not tomorrow. This is a concept fundamental to finance but that, for some reason, has not migrated into supply chain risk management.

Furthermore, that cost can take two forms: economic and financial. The former refers to costs that are visible and recorded within the company (e.g., higher capital costs, business continuity insurance, dual-tooling in manufacturing) and the latter refers to costs that are not always visible or recorded but exist nonetheless (opportunity costs of not entering a risky market, concentration risk in the supply base, reduced valuations, etc.).

If one accepts that risk is a cost, then risk management is simply the reduction of the cost of risk. These supply chain-related risk costs are present every day that managers come to work. And yet almost no discussion of supply chain risk management deals with the reduction of these present costs in a systematic, quantitative way.

Another way of saying the above is that every product has one price but two costs: the cost of the thing and the cost of the risk inherent in its production/delivery. Moreover, those costs are present each day that the supply chain operates and exist whether or not the supply chain is ever disrupted. They are inherent to the design and its operation, and this should be a subject of continuous quantification and management. This last point is the one many supply chain students, and even some professionals, find hard to understand and accept. Trained to think about supply chain risk from the insurer perspective, it’s hard for many to understand that the moment any risk is introduced to a supply chain a cost is also introduced that is a direct function of the underlying uncertainty. As in buying a house, the moment a buyer is made aware that there may be a contaminant in the land on which the house sits the value of the house is diminished. That same phenomenon exists in supply chains of every type.

Once this point is made, I take my SCRM students through an analysis of the typical drivers of CoR in most product supply chains, since together they make up the total CoR of the operation:

As I mentioned earlier, many major CoR drivers exist in the economic form before they exist in financial form. The point relevant to any analysis of COVID-19’s impact on supply chains is that (a) economic costs can convert into financial costs and that (b) this conversion has four features that can be observed and verified time and again.

- Feature 1: All major risk cost conversions are generally predictable, i.e., no major shift of a risk cost driver from economic to financial has occurred without warning. I liken the conversion precursors to ticks on a seismograph before a major earthquake; if you pay close enough attention, no major conversion should ever be a surprise.

- Feature 2: The moment of conversion is specifically unpredictable, but it is usually sooner than most models predict. Once the seismograph ticks become steady, a conversion is inevitable. We may not be able to say exactly when it will happen, but we can estimate it better and better as the intervals of the precursors decrease and their magnitude increases. Generally speaking, risk models tend to overestimate the time left before conversion, because the models are typically based on hypothetical conversion scenarios and not readings of the actual precursors in the field.

- Feature 3: The cost of conversion is always higher than predicted. Whatever you think the conversion will cost, it’s probably wrong and most likely by a wide margin of error. Take your worst-case scenario and make it much worse to approximate what probably will happen when the conversion finally arrives.

- Feature 4: All conversions are permanent, i.e., no major driver of supply chain CoR has ever moved back from the financial column to economic column. Once a CoR driver “flips”, it stays flipped. Counterfeiting, terrorism, climate change — all made the conversion in past decades and all remain financial CoR drivers to this day.

As with other CoR conversions such as the recession of 2007, 9/11 and climate change, the COVID-19 conversion of pandemic risk from economic to financial follows the same four features:

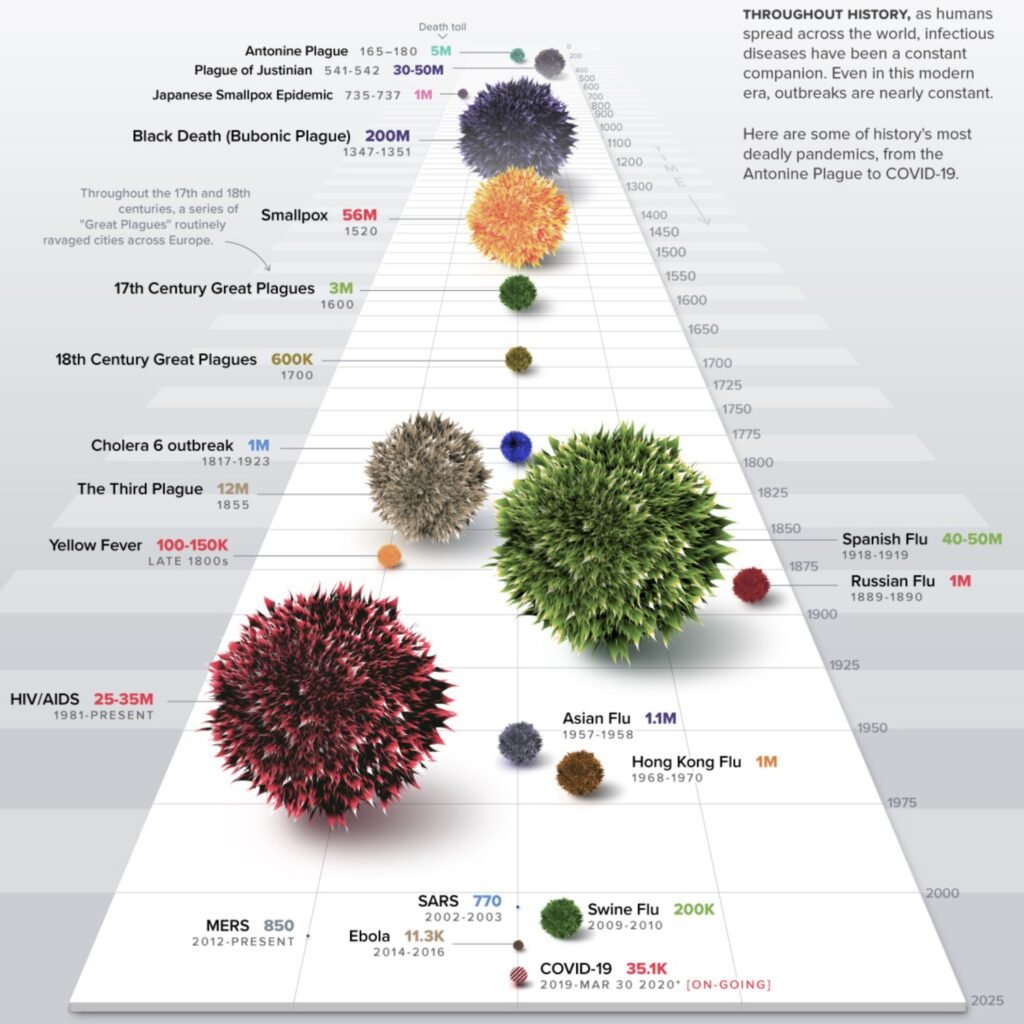

- The idea that sooner or later pandemic risk would convert should has been there for anyone who was looking, as this sample of a great visualization from the Visual Capitalist suggests:

- We could not predict COVID-19 would strike in 2020, but a look at the SARS-Ebola clustering was an indicator that the moment of conversion was probably getting closer.

- The cost of the COVID-19 will far exceed what most supply chain managers had in any of their worst-case SCRM models.

- Not one scientist within whom I have spoken believes that COVID-19 is a “once in a century” event. On the contrary, they believe that we are now in a world where such events will be a regular occurrence. However, much like financial crises, we will always be fighting the last outbreak, and it’s highly likely that among the manageable epidemics we will continue to see catastrophic pandemics like the one we are living through today.

The point of this post is that every supply chain operator should understand that a fundamental cost of risk driver conversion is taking place during the COVD-19 outbreak and not just a months-long disruption. It will be necessary to revise all CoR models from this day forward to take into account the fact that pandemic risk is no longer an invisible economic CoR factor but a very real financial CoR driver that must be calculated factored into any supply chain design and managed actively. Moreover, I use the term “supply chain” in the broadest sense of the term, since this conversion applies to all social and business supply chains, from food to health care to education. That’s not a happy thought, but it is the reality supply chain strategists and managers must confront once the crisis passes and they look toward the future.