Gone are those days when we would go to browsing centers to use the internet or play online games. The days when we used to rent DVDs to watch our favourite movies and always ended up paying a hefty fine while returning. As Louis L’Amour said, “The only thing that never changes is that everything changes.” The phenomenal transition from the industrial era to the digital era has exponentially increased this pace of change. Now people get everything they want in their fingertips. We no longer wait in lines to book tickets, nor do we patiently read through encyclopedias to acquire knowledge and information. More importantly, we no longer meander meaninglessly when it comes to choosing our products and services.

Earlier, people went to a coffee shop and ordered a hot coffee. Later came choices like cappuccino or espresso. Now, customers want grande nine shots, two pumps of mocha, nonfat, no whip, with five shakes of cinnamon stirred in. With more options available in the market, there is a visible change in consumer behaviour. Now more than ever before, people know what they want precisely and go for it. Marketing has been altered dramatically with the introduction of consumer psychographics. It allowed corporates to understand their customers better. They could cater to their specific needs effectively, leading to a branch of marketing called Niche Marketing. The days when soda was just restricted to Coke and Pepsi are long gone by. Now, it is PowerAde, Nestea, Minute Maid, Gatorade, Lipton and Tropicana sold by those two corporations apart from the former products besides several other smaller competitors. Companies are compelled to diversify to satisfy their customers. As customer tastes become more discerning, companies rush to find innovative solutions. It applies to almost all industries. The giants are of no exception to this upcoming trend. iPhones still have a colossal market share, but lately, Apple has been facing harsh critique for the lack of innovation during the launch of their new products. The company has even lost some customers to recent entrants like OnePlus.

Inhaltsverzeichnis

ToggleDawn of e-Commerce:

The emergence of e-commerce transfigured the dynamics of global economics. E-commerce became the fertile ground for the growth of niche markets where companies can appeal to their customers through marketplaces like Amazon and streaming services like Netflix and Spotify. Consumers are not ready to wait, and they aren’t willing to compromise on their buy. There is a ‘need for more’ culture rapidly traversing the world. Amazon is an e-commerce giant, considered to be one of the most customer-centric companies in the market. How is it possible for Amazon to be cost-effective and still satisfy its enormous customer base? This is possible due to their superior comprehension of their customers’ needs and command across their supply chain.

The E-commerce industry underwent a revolutionary transformation in 2020 due to COVID-pandemic. The demand for products and services online exponentially increased. According to a Forbes report, there was a 129% YoY growth in US and Canadian markets as of April 21, 2020, with online conversion rate increased by 8.8% by February 2020. Once the consumers experience the benefits of e-commerce, they rarely return to their initial platforms. One of the main advantages of an e-commerce platform from customer retention perspective is the array of diverse products available that would quench the thirst of buyers.

Pareto Rule in Supply Chain:

There is rapid diversification of products and reduced product life cycle as customers demand more, better and unique products. Now customers require everything to be swift and easy to acquire. It has led to multi-channel and more efficient distribution of products. Companies are yet to realize that the conventional supply chain mechanism isn’t effective anymore.

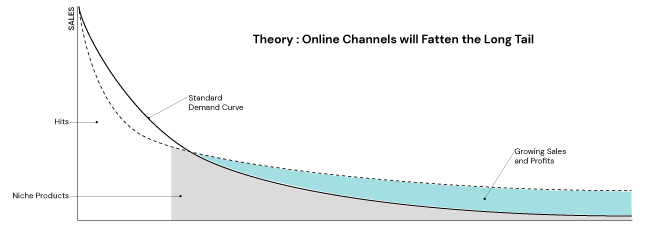

According to Pareto rule, companies made 80% revenue from 20% of their products and 20% revenue from 80% of their products. It led to ABC classification of the inventory which states that around 70-80% of the value is in 10-15% of units as A, 5-10% of value in 50-60% of units as C and the remaining 10-15% of value in 20-30% of units as B. The B & C inventories form the long tail of the supply chain. This long tail has become more complex and thicker. With increased demands for niche products, the value of B & C SKUs has significantly increased.

According to a report from Tools Group North America, food & beverages companies make around 36% of revenue from their tail, electronics industry make 44% revenue in tail and e-Retailers make a whopping 79% of revenue from their tail. Many companies have not prepared their supply chain for this evolving realm of business. It erodes the profit margin and reduces their market penetration. Companies are focusing on perfecting the demand forecasting to help them plan their course of action. They need to realize that no more can they figure out the 20% of products that matter most to their revenue. They should equip their supply chain with the right strategy and technology to sustain in this ever-changing world, like how Amazon does.

Sourcing’s Vantage Point:

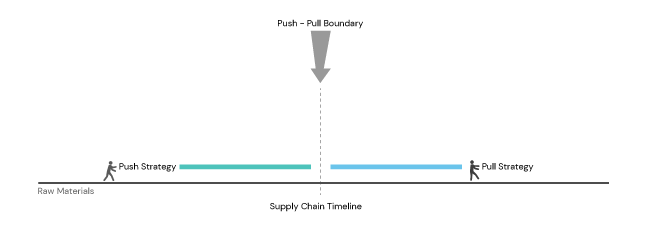

‘Buckle up your bootstraps!’ ‘Gather your battalion!’ Companies have to transform their supply chain from the start to end. They have to mobilize their battalion at the starting point of the supply chain by implementing strategic sourcing in supply chain management. They have to orient their procurement strategy to mould their supply chain, not just efficiently but also to become market-responsive. There was a well-demarcated push-pull boundary differentiating push strategy in the beginning processes of the supply chain followed by pull strategy. This principle cannot be blindly followed anymore, as the demand has become uncertain with shorter shelf-life and customized products available in the market. Now, companies have to develop a pull strategy throughout the supply chain starting right from sourcing.

To adapt to this expanding long-tail, a company must reduce its production time. It can be made possible with component commonality and delayed differentiation in the product design. The procurement team has to identify the common components in the manufacturing of various products of the company. It reduces the risk of uncertainty due to the demand pooling of several products. It gives companies an edge to develop multiple products from generic raw materials. Dell is one of the best examples to demonstrate delayed differentiation where they outsource several components and assemble the product once the customer orders. It allows Dell to customize their PCs and decrease the production period. It increases market penetration and product diversification.

Companies have to alter their sourcing process to follow the pull strategy. Certain key aspects of procurement that companies should focus, to become more market responsive are:

Supplier Selection Criteria:

Initially, the two main criteria would be cost and quality in selecting the supplier. With this altered long-tail, companies need to focus on contracting with suppliers who are agile, flexible and provide quality products on an as-needed basis.

Category Management:

This allows organizations to segment their spend into parts that contain similar or related products. It enables companies to focus on opportunities for consolidation and help them to implement component commonality strategy in the sourcing.

Supplier Diversification:

Larger supplier base would be required in the pull strategy, unlike the push. It would reduce the risk associated with supply and also increase the negotiating power of the company.

Supplier Relationship Management:

Companies must have good rapport with their suppliers. It would establish a clear communication channel and ensure stability in the procurement process. Suppliers perform better if they get better visibility of what is coming down the line.

Spend Analytics:

Companies have to keep an eye on spend of both direct and indirect procurement. With increasing product lines, companies would face an inevitable increase in their expenses. To be cost-effective, they have to track and analyze their spend regularly.

In this digital era, companies would require procurement software that would help them adapt to this new normalcy. Sourcing can be a tedious process that would require a lot of manpower and time. MeRLIN is a strategic sourcing software that would help companies with their sourcing challenges. Sourcing software such as MeRLIN automates several tasks, helps manage suppliers, tracks spend and helps implement strategic sourcing at ease.